Some view Innovation as an abstract, serendipitous event. We have shown through dedicating our lives to research applied in practice that this is not true. There are more efficient ways to succeed with your innovation projects if only you know what to look for! The below resources will help you get a better understanding of that.

Mitigating risk with innovation portfolio management

Innovation portfolio management

When you have an established innovation engine with an innovation management system, innovaiton portfolio management becomes a key part of your activities. Portfolio management is the tool that allows you to focus resources where they can create the most value.

Interdependency

Imagine this situation: you have a number of projects that you want to execute. At the same time, imagine that you have fixed a number of resources that can be used to execute the projects (resources such as innovation managers, or programmers). Faced with this situation you can optimally execute all the projects if there are no interdependencies (i.e., the execution of one project does not affect any other project in any way). Without interdependencies you can safely execute all the projects at the same time.

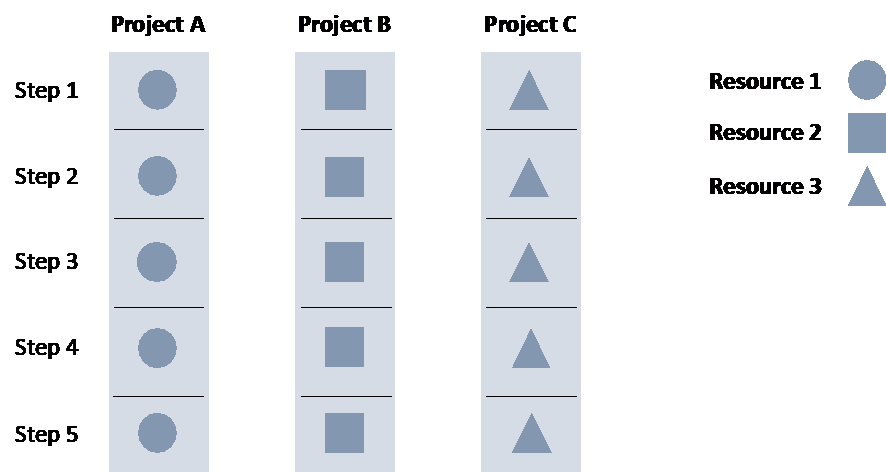

Independent projects

Three projects without interdependence. You can execute on all projects simultaneously without issue.

Once you have projects that are independent you have to make choices. You need to prioritize which projects get what it needs first. Projects might be interdependent if they need the same resource, or need results from one project to move forward on another. The priority of one project over another can be self-evident, but in many organizations it is not. A project might be chosen for reasons that has nothing to do with business logic. There might be stakeholders interested in project outcomes. The project might get a stamp as poor and stigmatized if it has not been chosen. Careers can be tied to the success of projects, or certain executives can have pet projects. All these social phenomena can lead to choosing projects that are less than optimal from a strictly operational perspective. If the portfolio selection instead is governed using formal processes there is a much bigger chance of the right projects being put forward for execution. This is true regardless of what type of portfolio you handle.

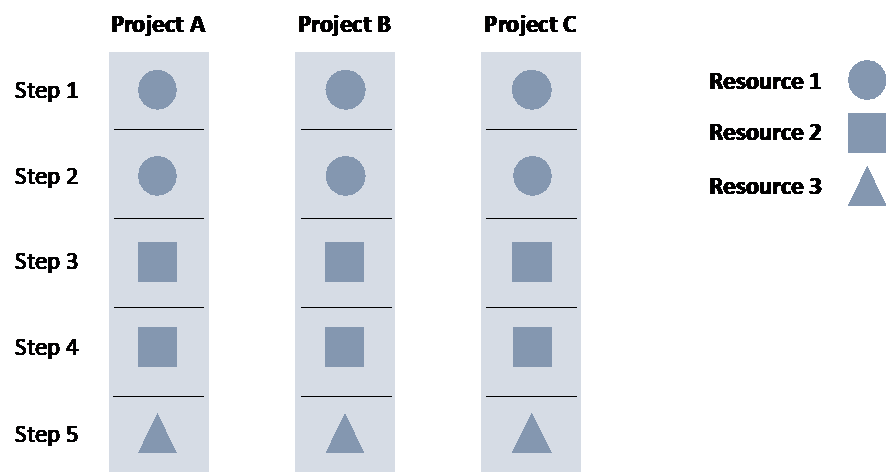

Interdependent projects

All three projects require some work from all three resources, an example of interdependence. To execute the projects, you need to prioritize which project to launch first.

What do you need to have in place for effective innovation portfolio management?

In our experience, there needs to be a mechanism in place at any given time to answer three questions about your portfolio of projects, whether they’re continuous improvements or disruptive new solutions.

- Strategic direction: Are the activities we are performing in line with our strategy, and are we distributing our resources so there’s the best possible chance of executing the organization’s strategy?

- Priority: Which project should be prioritized above others, based on value and resource availability? Valuation of projects should be the basis for prioritization. (Of course, projects can be chosen for other reasons, but that should be a very conscious decision.)

- Value: Is the potential upside of the portfolio big enough for us to reach our growth targets (in best and/or worst cases)? What type of projects do we need in order to fulfill our goals of value creation?

These three basic assumptions lead to further considerations for portfolio management. Let’s investigate each point in more depth. We’ll provide a number of general recommendations for getting on the path to achieving innovation portfolio management excellence.

Strategic direction

The first thing you need in order to determine if the strategic direction is being fulfilled is—surprise!—a clearly defined strategy. This may seem self-evident, but we’ve found that clearly defined innovation strategies are often missing in this world. When working with clients we often find that strategic direction is lacking or has been built in a very ad hoc manner. Defining a number of strategic initiatives makes it easier to determine the “fit” of the projects knocking on the door with the innovation portfolio.

One way to create a coherent, useful, understandable innovation strategy is to look at external opportunities and internal abilities in your organization to delimit your opportunity space. The external opportunities can then be “filtered” through vision and mission, the corporate strategy, and any specific goals set by the organization. This can be a starting point for determining where your efforts should be spent.

Priorities in the innovation portfolio using the Innovation Horizons

How can we value something that is barely started, with heaps of uncertainty about what type of revenues can be expected, and compare it to something that may be an extension to an existing solution or a way of working with a very predictable cash flow? The short answer is: We can’t and in fact we should avoid doing so. Projects should be grouped according to uncertainty.

At Innovation360 we recommend adopting a horizon model, where Horizon 1 is improvement to the existing core, Horizon 2 projects are growth related, and Horizon 3 is about identifying new growth opportunities. That way projects can compete for resources in a level playing field. The amount of resources available for each horizon should be predetermined, depending on the appropriate risk level of the portfolio given the growth targets of the organization.

We also need to have a good idea of which internal and external resources are required to execute each project. Specific resources often become bottlenecks for execution, especially in knowledge work, where certain content experts can be needed for all of a specific organization’s projects. Once bottlenecks occur and are loaded to their full capacity, it makes no sense to push more projects into a project funnel. The only thing that will happen is that the projects will start to get delayed, and the overall value creation will slow down as a result of all the multitasking. It is therefore extremely important to choose the right projects and be vigilant about starting any new projects. Only do so once capacity is available. This way of thinking leads to some basic insights.

- Your resources should not all be 100% busy with execution. Only the bottleneck resource should be. In a dynamic environment it can be quite difficult to identify bottlenecks, which means that a good rule of thumb is to avoid loading resources to 100% in all cases.

- Having fewer projects will likely increase the number of projects that will actually be finished in any specific time period.

- Freeing resources from non-productive busy work opens you up for more radical innovation, which is often put on the back burner when an organization is overloaded.

Manage by value for closing the gaps in your innovation portfolio

The exact value of the portfolio is not important. What is important is that the overall potential is large enough to fulfill growth targets, given a relatively predictable hit rate. The projects in a portfolio will be either incremental or radical. Incremental projects can often be valued based on knowledge and experience, while radical projects suffer from being executed toward the unknown. This is one reason why incremental innovation has a tendency to be prioritized over radical innovation. If a portfolio becomes too incremental it is unlikely that the organization’s potential is maximized. One way to get around this behavior is to strive to understand whether the incremental projects will really get the organization where it needs to go (probably not). The value of radical projects can be evaluated on a basic level to get a general idea of what success could look like. It is then possible to evaluate the overall portfolio potential. It is important to note that just because the potential of a radical innovation project needs to be large, does not mean that the project should be large and expensive (at least not at the start).

By understanding the potential your portfolio needs, you can also determine an appropriate mix of risk. The Innovation Horizons provide you a tool that determines the appropriate level of risk in your portfolio. Using them as a guide, you can predetermine how much resource should be spent in each horizon. This makes an overview of the portfolio easier, and portfolios for each horizon can be managed separately. Note that a part of the goal is to transfer projects from one horizon portfolio to the other.

There are a few ways to think about the value of a project and different methods work for different levels of project maturity and horizon. Let’s take a closer look at them.

Throughput accounting: Look at what contribution margin a product/service/improvement will add, how much inventory or investment will be needed or removed, and how much overall costs of personnel and facilities will go down. This will be an indication of the final value of the project. This method is simple and straightforward, but does not normally take time into account, at least not at the basic level. This approach is very useful at the beginning of a project to understand orders of magnitude. For an introduction to throughput accounting, read more here.

Real options: By looking at different chains of possibility for the progression of the project, optionality can be built that improves the value of a project. These can be opportunities to sell IP from projects that fail commercially, or ways to get other differentiated outcomes. Using real options allows for riskier projects to be valuated with a discounted cash flow model and compared to other projects on a more equitable basis. The drawback is that the models can be difficult to explain and rather involved to calculate, and might require some software like Crystal Ball. It’s very useful if you belong to a larger organization that requires more involved predictions. For an introduction, read more here.

Net present value: In situations where you have enough experience to make relatively reliable predictions, you can calculate the net present value of the project to determine its value and compare it to other projects using comparable units. Simply model the cash flows over time (including investments), the steady state value, and conclude whether the investment is a good idea or not, both in general and compared to the other projects in your portfolio.

Scoring methods: Set up a number of criteria, and score ideas and projects based on the criteria. This is useful for very early stage projects where even throughput accounting might be difficult to apply. What you are doing is essentially requiring some strategic direction from the projects and a sense of overall potential.

How to get started weighting your innovation portfolio

A very useful first step is to take inventory of your current innovation projects. What does your balance between three horizons look like? It is not unusual to have a balance that focuses heavily on Horizon 1. Set a goal for your own distribution among horizons and follow up over time. Make it clear that resources will be redistributed to riskier projects.

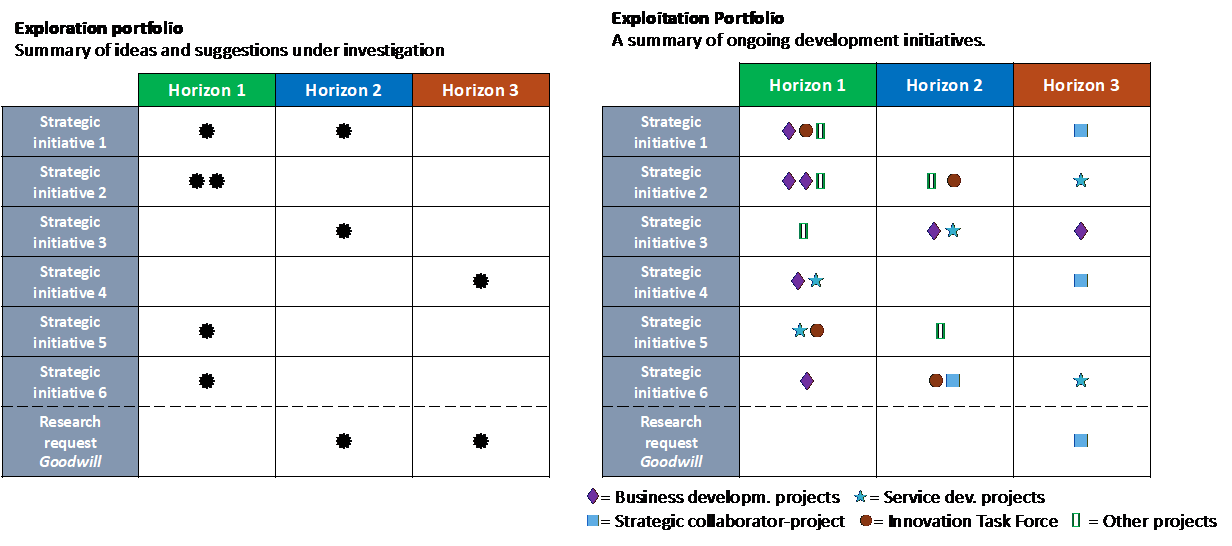

Exploration and Exploitation portfolios

Simple example of a first project inventory, showing the activities in exploration and exploitation as well as a “who does what.”

When we examine InnoSurvey® data on innovation, we find that project selection is usually weak; i.e., the main weakness is working with ideas to get good enough data to make effective decisions. This becomes a bottleneck in itself when ideas get funding before key questions are answered. Hence it is useful to look at how you manage projects. Irrespective of the horizon, you will likely see very good results by requiring more work and data from your own organization before you give the go-ahead to spend big bucks.

To allow for a strong relationship between portfolio management and the innovation process, it is useful to divide the portfolio into two parts: Exploration and Exploitation. Exploration is the first part of the innovation process, involving ideation and selection. Exploitation, the second part, addresses development and commercialization. The portfolio should be managed for both phases. This is most easily achieved by simply splitting the portfolio management function and having separate overviews for exploration and exploitation. The logic is that you need enough ideas being explored in order to have a good enough funnel of projects at a later stage. You should have a portfolio governance function that acts as a gateway between exploration and exploitation. This way you can also avoid overloading the later parts of the innovation process.

In the decisions along the way in the innovation process, a useful tool to determine if you should continue funding a project is the “RWW” framework. The RWW framework answers the questions, “Is it real?”, “Is it worth doing?”, and “Can we win?” “Is it real?” is a question of whether the market and the product is real, and has little to do with strategic direction. “Is it worth doing?” explores whether the product (or service) can be competitive, and if your company can be competitive. “Can we win?” is asking if we can reach profitability at acceptable risk, and if we have enough support from our own organization to carry things through to the end. A clear “No” to any of the questions in the framework should be cause for concern and a likely death sentence if the answer to the question can’t at least be changed to a maybe.

It is also useful to set up some metrics for your portfolio. Here are a few suggestions:

- Projects per resource (ideally no more than 2!)

- Number of projects in Exploration

- Number of projects in Exploitation

- Possible value of Exploitation projects

- Success rate of projects launched to market (determine what success means before launch)

- Time between milestones

- Touch time per project

Summary

Portfolio management is the key to the overall performance of your innovation activities, once you have a system in place for execution. It can save you from creating bottlenecks, and if adhered to will allow for best-in-class innovation processes. With a strong portfolio management function in place, management can maximize the value potential at all points in the innovation process. It is important to understand that potential does not automatically mean an expensive and or resource-intensive project. Make sure that data is created early and before major funds are committed: this is key to maximizing value for return.