By studying over 1,000 companies in 62 countries and all continents over the past years, we have not only built the largest 360-database with multiple respondents in each company (external and internal stakeholders as respondents for a full 360°) but we have also been able to refine and develop our methods for analysis and management of innovation.

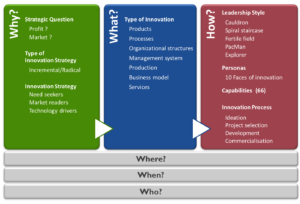

Aligning strategy, leadership style, culture, capabilities and competences is the key to success in building an innovative and sustainable business in today’s ever changing market context. Figure 1 shows Innovation360´s framework of innovation and how the different concepts are interlinked. Beside what’s shown in Figure 1, competences are crucial, but the capacity to learn is what really counts (and is also a subset or the 67 capabilities in Figure 1).

Figure 1. The Innovation360 Group´s framework for innovation management. Based on Penker (2011).

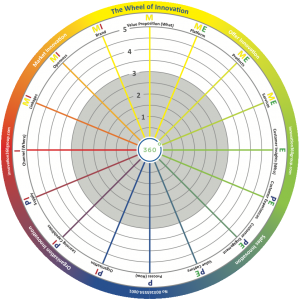

At the heart of innovation lies a fundamental understanding of its nature, which is to challenge the status quo by making things that are better and totally different using existing elements (resources, capabilities and competences) in new ways. The reason for innovating can be to follow the market, satisfy needs not satisfied at the moment as well as using technology to make something possible that was not possible before. Innovation can be done in small steps (incremental) or in leaps (radical). Everything external (E) as well as internal (I) can be innovated. Some things impact profit (P) and some market share (M), as can be seen in the Innovation Footprint in Figure 2 (The Wheel of innovation). See the M, P, I and E marks on the figure.

Figure 2. The 16 overall aspects grouping the 67 core capabilities driving innovation (the 16 aspects is based upon the 12 way of innovating by Sawhney, Wolcott and Arroniz, 2006). These can be measured and benchmarked using the free version of InnoSurvey™ (register here).

Typical external innovation (the right part of Figure 2) is about how to organise for efficient customisation of deliverables, typically used in Industry 4.0. Designing intelligent building platforms able to deliver customised products and services is the core of external innovation together with understanding how to create a superior customer engagement and experience.

Internal innovation on the other hand (the left part of Figure 2) is about how to organise for knowledge creation and sharing, production, process development and redesign, supply and cross-border learning. Artificial intelligence will most likely be a driving force in the development of internal innovation over the coming years,

The upper left quadrant (MI) in Figure 2 is where market innovation takes place. Typically, this is where you use external resources in an open co-creation process to achieve a larger accessible market through building value nets and growing the total market. An example is Tesla and how Elon Musk gave away patents to grow the electrical car market instead of fighting against all car manufacturers and eventually ending up in a declining and/or price-pressured market. As you can see in Figure 2, the quadrant is next to offer innovation (see below) and organisational innovation (see below) and there is an interaction between those actions.

The upper right quadrant (ME) in Figure 2 is where offer innovation takes place. It is typically based on sales innovation (see below) and market innovation. There will be a structured innovation process for products and services organised in platforms for product or service lifetime management and product or service document management. Examples are all the companies with a structured new product development (NPD) process. Superior companies are often found in, for instance, the fast moving consumer goods (FMCG) and consumer electronics industries.

The lower left quadrant (PI) in Figure 2 is where organisational innovation takes place. Typically, professional services firms (PSFs), and high-tech and pharmaceutical companies put a lot of effort into this area, creating superior structural capital and knowledge processes and a nest of suppliers. This quadrant is next to sales innovation (see below) and market innovation, making it possible to develop the market and sales.

The lower right quadrant (PE) in Figure 2 is where sales innovation takes place. Typically, it is where you create something new and exciting based on customer insights. This drives sales and loyalty, generating recurring revenue and high lifetime value. One very good example is the App Store in Apple, which creates superior experiences and is constantly used to understand patterns and behaviour at the same time as dragging you into an echo system that is hard to leave. Sales innovation is based on the work of organisational innovation and offer innovation, but it is centred around the experience and engagement itself. This is by far the most underdeveloped area, which we also clearly see in all data regardless of geography and company size. This was also something pointed out at the Davos meeting in 2016.

However, to be able to compete today, tomorrow and the day after, it is not enough to do one-off organisational work. You need to organise to drive innovation in several horizons. According to Steve Coley (2009), innovation work can be divided into three parallel horizons. The first horizon (H1) is about incremental innovation in today’s business, extending the existing S-curve of the company. Horizon 2 (H2) is about expanding and building new business (the next coming S-curve, a mix of incremental and radical innovation) through innovation. Horizon 3 (H3) is an explorative and radical approach to future S-curves, to be commercialised in H2, ending up in H1.

The different horizons call for different strategies, leadership styles, cultures, capabilities and competences – which is the subject for coming blog posts and articles.

To make a free innovation assessment getting your own innovation footprint with a global benchmark and alignment analysis between strategies, leadership style, culture and capabilities click here.

While everyone might agree that innovation is essential for an organization to thrive in today’s fast-paced business climate…

While everyone might agree that innovation is essential for an organization to thrive in today’s fast-paced business climate…

The self-paced course is for individuals who would like to do our Basic Online accreditation (IMBA) at their own pace without…

The self-paced course is for individuals who would like to do our Basic Online accreditation (IMBA) at their own pace without…