Some view Innovation as an abstract, serendipitous event. We have shown through dedicating our lives to research applied in practice that this is not true. There are more efficient ways to succeed with your innovation projects if only you know what to look for! The below resources will help you get a better understanding of that.

Omni Channel 2.0 – The innovation of Retail Business Models

Due to radical and partly unpredicted change in consumer behaviour, the retail and FMCG industry is going through a change that is both potentially highly rewarding yet also potentially punishing. For some it is a blessing and for others it may mean a slow death. Macro key drivers, such as low interest rates (which are currently driving R&D and merger & acquisitions), and exponential technology developments are constantly increasing the rate of change, while globalisation is driving an increasing demand for transparency on price, quality, sustainability and ethics.

Consumer behavior is changing

Behaviour wise, we see that consumers are changing too; they are demanding higher services, demanding more of their products, but still they always want the option to consume as well as to express themselves in different ways, i.e. wanting to be unique, with a sense of selfness (the “selfie”).

Higher expectations off service and demand drives an increased number of returns/repurchases, increased requirements for part-delivery, and increased demands for fast delivery (even the same day), as well as the use of multiple payment methods.

Omni Channel means a demand for an increased number of available channels, for seasons and opening hours to disappear. It represents consumers becoming producers and vice versa; in the modern age, the lines are blurring and basically everybody is a possible buyer, seller, consumer and/or producer of material and immaterial deliverables.

There is an ever increasing number of product and service-models available, with increasing range of sizes, colours and functions that are all drive the long product tail and offering uniqueness. Customised products and services are taking off: everything from semi-customised to fully customized deliverables. We see more and more ”disruptive innovations” such as retail service robots, fully automated warehouses, and even built-in functions in products such as in food, home electronics, textiles and bags.

The selfie trend is also impacting consumer behaviour extensively. Social media has gone from being a competitive factor to a hygiene factor, we see rapidly increasing amounts of “earned”, ”shared”, ”native” and “owned” content. Additionally, there is an increasing rise in second-hand markets and thus sustainability issues, with requirements for upgrades, reconditions, repairs and modifications.

The Omni Net

What’s new is that the old assumptions that you should offer the same price, assortment, and service level in all channels is now being questioned. However, it is not that simple. But what we increasingly see in our assignments and in our industry analysis is that you have to take the channels, key drivers and relevant KPIs into consideration before making decisions about pricing, assortment, stock levels, service levels, store design, visual merchandising, branding, content marketing and sales training.

Today, at least the following channels need to be taken into consideration:

- E-Com

- M-Com

- Bricks-and-mortar

- Native, shared, owned, earned content

- Price compare and ranking sites

- Communities: own and earned

- Service centres

- Products in themselves

- Delivery counters (if not bricks-and-mortar).

The key drivers are as earlier mentioned: uniqueness, service & demand, omni-channel and the ”selfie”. The most important KIPs to analyse when designing and sharpening the future of the retail and FMCG industry from a sales and marketing perspective are:

- Number of visitors

- Conversion rate

- Average order.

- Customer Lifetime value

All of this then can build up the revenue and profits of any omni-channel net.

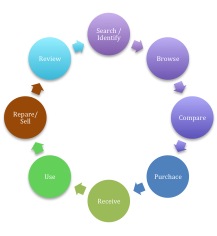

Omni Channel net is built up from a number of touch points that consumers already have today, as well as from a chain of interactions more or less always carried out (whether consciously or subconsciously). Normally, a consumer starts with identifying or searching for a product or service, it could be that they have a specific need or maybe just that they have seen something that has made them interested in something new. Many consumers then start to browse, either by searching on the internet or by visiting stores. Then, most consumers start to compare, systematically by asking questions among like-minded communities and by reading comparisons, or by reading on price-comparison sites, or even just by “goolging” or asking friends. During this phase, you (sellers) can actually trigger purchases and set the expectations, or even can just make sure that your are mentioned in a positive way. Purchases should be easy and on the terms and conditions stated by the consumer – the less clicks, the better. And the more possible device that the consumer can use to make the purchase, the better. The reviving phase is normally underestimated, everything from the experience when collecting it (e.g. in the store or mail), to when unpacking the goods and services, this all counts and sets the scene for the next phases, which is installing, using, repairing, selling and/or reviewing it. The second-hand market and the market for repairing and reconding is growing fast, but is also getting more and more inherited in the new suitable approach of customers. The Omni-Channel web is constantly growing and getting more and more complex, and therefore our advice is to take a holistic approach based upon consumer insights, technology developments and fast adoptions.