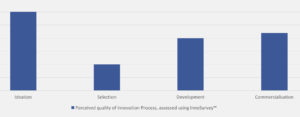

What’s the hardest part of commercialising innovative concepts? Let’s figure it out. First, the Innovation Process consists of four phases; Ideation, Selection, Development, and Commercialization. In our global analytic tool and database, InnoSurvey™, we measure the Innovation Capability needed in each an one of this phases. According to our data it turns out that Selection is the phase perceived as most challenging, where organisation generally struggle most with organisation, and are not properly trained.

Decision making in strategic uncertainty

Table with InnoSurvey results showing Selection is perceived as the hardest phase in Innovation Process.

That makes sense because people tend to be much worse at making rational decisions than they think they are. One of the key areas where that irrationality impacts innovation is in risk aversion. Nobel-prize winning research by Herbert Simon, Amos Tversky, Vernon Smith and Daniel Kahneman demonstrated that people make decisions based on the relatively small amount of information we are able to keep in our usable memory, and those decisions lead us to prefer avoiding losses over seizing gains.

Whenever a subject is offered two exclusive choices, one where they can avoid losing $5 and another where they can find $5, the majority of people instinctively go for the first option. In some experiments, the threat of loss was found to be twice as motivating as the promise of an equivalent gain.

You can see how this has become a problem for innovators. Innovation has to face the stiff winds of this loss aversion alongside the tendency to trust in the advice of authorities instead of hard data. In an earlier blog, we talked about the hypothesis-based approach to innovation, why it works and yet how few companies actually use it. Instead of relying on experts and confirmation bias, this approach presents a more scientific basis for selecting the most practical and profitable innovations.

The Danger Built Into Avoiding Risk

Risk aversion is often treated as a more responsible, measured and conservative methodology that holds business continuity in the highest regard. That may be true under different initial conditions, but it certainly is not valid in a turbulent global economy roiled by disruption. In this world, risk aversion is too shortsighted and can relegate a business to irrelevancy. This is actually where handling strategic uncertainty is turned into risk mitigation.

That’s exactly what happened in the case of Kodak, where management clung to their traditional specializations and avoided investment in digital photography. At the time, managers did so out of fear that the new technology would cannibalize their core business. Instead, other companies embraced the new technology, dined on Kodak’s revenues and forced the company into bankruptcy. A restructured Kodak has now ventured back into the marketplace, but only time will tell if this case study has a happy ending.

A study by Columbia University showed that risk-averse managers tend to act conservatively as long as they feel confident that everything is proceeding according to plan, but they take far more dangerous, irrational risks when they feel that this may be their only way to bring back the status quo.

Consider how this applies to the three horizons of innovation. As a reminder, horizon 1 refers to minor tweaks to existing services and quality improvements that can be done right away. Horizon 2 refers to innovations that are reasonable extensions of the core value that could bring back returns in the middle term. Horizon 3 says innovations are the moonshot proposals that have the greatest revenue potential but also brings the greatest uncertainty.

The risk-averse will nearly always prefer horizon 1 proposals and fund horizon 2 proposals based on expert opinion instead of experimentation. However, there are better ways to select the most promising innovative projects for investment. How to proceed depends on how radical the innovation is.

System 2 Problem-Solving Under Strategic Certainty

One decision-making solution to recommend when you are within an area of strategic certainty is based on research from Keith Stanovich and Richard West in which they identified System 1 and System 2 thinking. System 1 refers to how most people operate in their daily lives based on intuition. These decisions are rapid, automatic, reactive, implicit and driven by emotional associations.

In contrast, System 2 is the more labored, deliberate, explicit, evidence-based decision-making process. This normally consists of six logical steps:

- Define the problem.

- Identify the top criteria needed to adequately compare your options.

- Rank the significance of the criteria according to weighted averages.

- Generate a list of the available options.

- Assign ratings to the options, and compare them head to head.

- Choose the highest number.

You may actually need a seventh step in many cases: If there is a tie, do more research on the leading options and then go back and enlarge the criteria pool.

Clearly, if you are just choosing jam for your toast, a complete System 2 process is counterproductive. System 1 has been refined over hundreds of thousands of years of evolution, so it is quite capable of handling most of our decisions. Only the decisions of the highest import, where businesses and careers are on the line require System 2.

The larger problem with innovation in the corporate world today is that far too many projects are funded after some version of System 1.

In many cases, however, business leaders have to make critical decisions with no data to compare because it’s never been done. Problems like that require a new kind of thinking and new kind of strategic leadership.

Problem-solving Under Strategic Uncertainty

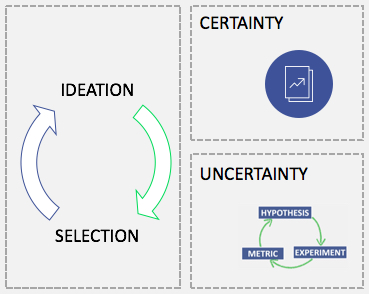

When you are trying to innovate radically – in the face of strategic uncertainty – you by definition do not have any prior data to use as your basis. That’s where we recommend the hypothesis-based approach, and we’ve devoted an entire blog to the concept.

Decision-making in strategic certainty (business case) versus uncertainty (hypothesis-based approach).

The hypothesis-based approach is closely related to idea of “fail fast and fail often.” By running rapid tests of simplified models, you learn more that any amount of theorizing. Just as the research of Kahneman and Smith revolutionized economics with the prioritization of experimentation over analytical projections, this can be a revolutionary way to execute innovation.

By spending less time and resources on desk analysis, you can move directly into testing hypotheses. That reorders the idea selection-phase to protect your company from decisions based on gut-feelings backed up by confirmation bias. Now you can begin to build a culture where employees conduct experiments instead of just float ideas. You’ll select the most practical innovation pathway based on proven hypotheses instead of unproven ideas and turn them into innovation project with higher probability to succeed and create longer lasting business value.